Money Manager App

Written by William Urbanski.

Ah, the eternal question: “What happened to all my money?” Most people reading this have probably spent a large part of their life pursuing money and yet feel they have precious little to show for it. It’s also probably fair to say that most people would like to hang on to more of their hard-earned bucks. Common knowledge suggests that in order to have a little more left over at the end of the month, what you need is a budget. Well, if you’ve worked for more than five years and are constantly running out of money or don’t have at least a few grand at your disposal, what you really need is a swift kick to the back of your pants. You also need to start tracking where all you money goes.

Tracking personal expenditures is important for a number of reasons, the most important being that you can’t manage what you can’t measure. The second reason is that it elevates spending to a conscious, deliberate act rather than just a habit. By adding an extra step (such as writing down each and every purchase) it also acts as a barrier to spending. That is, you’ll take one extra second to consider a purchase because you’ll know there’s an extra little thing you’ll have to do. As well, forcing yourself to take a cold, hard look at your financial exploits at the end of every month is antithetical to self-deception.

For many, many years, I followed a simple but rustic (and dare I say, rugged) system of tracking my purchases. I paid cash, kept the receipt, and then logged it manually into a notebook under an assigned category. Then at the end of each month, I’d tally up all the expenses by category, which would give me a very clear picture of where my money went. This process may seem tedious, and at times it certainly was, but I don’t regret doing it. That being said, after keeping on the straight and narrow for a number of years, I noticed a number of problems arose, mostly due to my own laziness. The biggest problem was that often, I simply wouldn’t record my expenses every day and seemingly every week, I would have a big stack of receipts that had to be logged. This was time-consuming. The other major problem was that I was actually keeping two separate records: one for logging the day-to-day expenditures and one for summing them all up. Eventually, I did switch to using Excel to do some of the work (there were reasons why I stuck with pen and paper for so long), but logging the receipts and busting out the calculator to do some good old-fashioned number crunching was just taking too much time away from burning my eyes out on Instagram and YouTube. So, the search for a new system was afoot.

It was around this time that I remembered that smartphones exist and someone had probably solved this problem already. And so, it came to pass that I found and tested a number of apps that use a newfangled technology called Optical Character Recognition (or OCR). Using OCR, the apps could take a picture of a receipt, extract the financial information and log it automatically. Deus ex machina! Actually, not quite, because pretty much all these apps were steaming piles of odorous excrement. The biggest problem was that to use the OCR technology in the first place, the user has to pay per picture and it is not cheap, in the range of 20 cents. Paying that kind of money basically undermines the whole point of me tracking expenses in the first place, so the search continued.

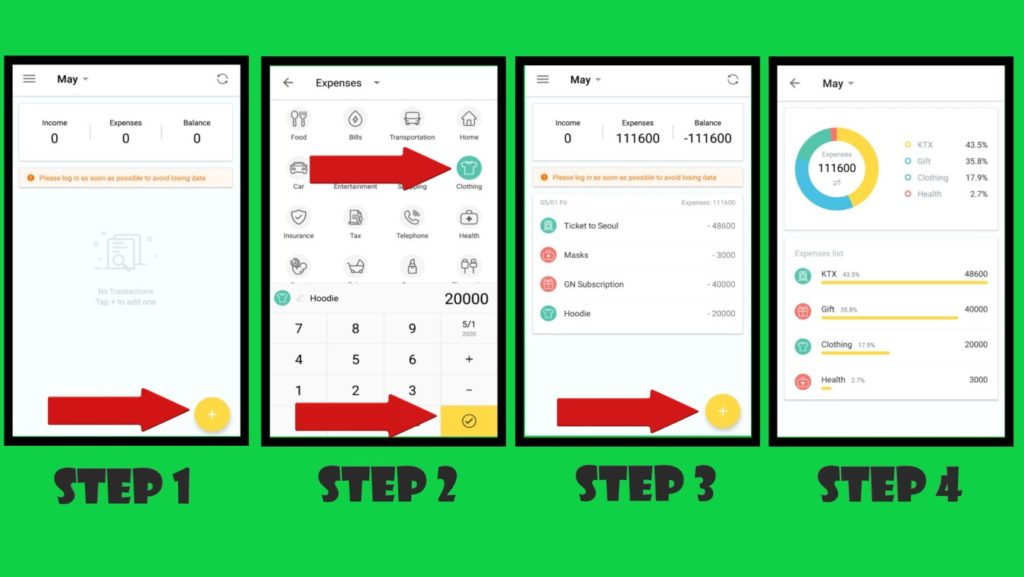

Ultimately, I stumbled upon one of the best, simplest, and cleanest little apps ever. Money Manager is brilliant in its simplicity and extremely intuitive. Not only is the app free to use, it’s also free of banner ads or any other advertising. After opening the app (which takes up less than 30 MB), you see your running total for the month. To add a purchase you just have to click the yellow plus sign at the bottom. From there, you can choose from a plethora of pre-determined categories (or even make your own) to which you add your purchase. Next, you enter the amount of the purchase, add a memo (if you want), hit the check mark and, voila – the amount is automatically logged and added to the running total. All these purchases are input into a pie chart that neatly and simply summarizes your expenses, both by aggregate total and percentage, so you know, to the won, exactly how much you’re spending.

• Step 1: Open the app and tap on the yellow plus sign.

• Step 2: Choose a category, enter the value, and tap the check mark. You can also add a memo if you’d like.

• Step 3: The expense is automatically recorded in an easy-to-read chart. Tap the plus sign to repeat.

• Step 4: All the expenses are displayed as percentages, totals, and in a pie chart.

As alluded to above, you have the choice of creating your own categories, a feature that you should definitely take advantage of. I’m not going to get into the exact reasons why, but when tracking your expenses, the more numerous and precise the categories, the better. Being able to personalize the app this way (with cool, bold icons) really makes it fun to use.

Probably one of the best features is that, unlike certain apps that require you to link up all your bank accounts and credit card information, Money Manager needs nothing. There’s an option to connect it to Google or Facebook, but you can still enjoy most of the benefits without doing so. And why would you want to give this information away (or indirectly make it available) anyway?

In his amazing book Homo Deus, Yuval Noah Harari draws an interesting parallel between the natives of the New World hundreds of years ago and the modern people who so readily give away their data to the tech giants. The natives traded away vast tracks of land in exchange for trinkets from the visiting Europeans. Even though the mirrors and shiny combs were things that natives couldn’t produce themselves, nobody in their right mind today would say that they got the best of the deal. As we steadily transition into a knowledge-based economy, where knowledge and data are the most valuable assets, understanding the value of your personal information and thinking twice before giving it away is paramount.

A large contingency of people resists financial planning out of fear that it will make them look cheap. Or worse yet, they subscribe to platitudes such as “keeping track of money takes the fun out of spending it” or “YOLO, baby!” Well, there’s something worse and more painful than spending a few minutes each day to click an app – and that something is constantly running out of cash. Tracking your spending definitely won’t solve all your money problems, but it’s the quintessential first step.

Think for a moment about how much of your daily routine involves getting ready for work, commuting to work, being at work, and sitting on your rump because you’re so tired from work. Even if you get paid for being at the office for 40 hours a week, it’s likely that your job is really sucking up somewhere in the neighborhood of 50+ hours per week, far more than you spend with your friends and family. For all the trouble you spend making your money, doesn’t it make a little sense to figure out where it all goes?

THE AUTHOR

William Urbanski, managing editor of the Gwangju News, has an MA in international relations and cultural diplomacy. He’s married to a wonderful Korean woman, always pays cash, and keeps all his receipts.

Instagram: @will_il_gatto